Want to read more?

Our entire resource library gives you up-to-date insights on critical issues showing how the power of data produces real business solutions.

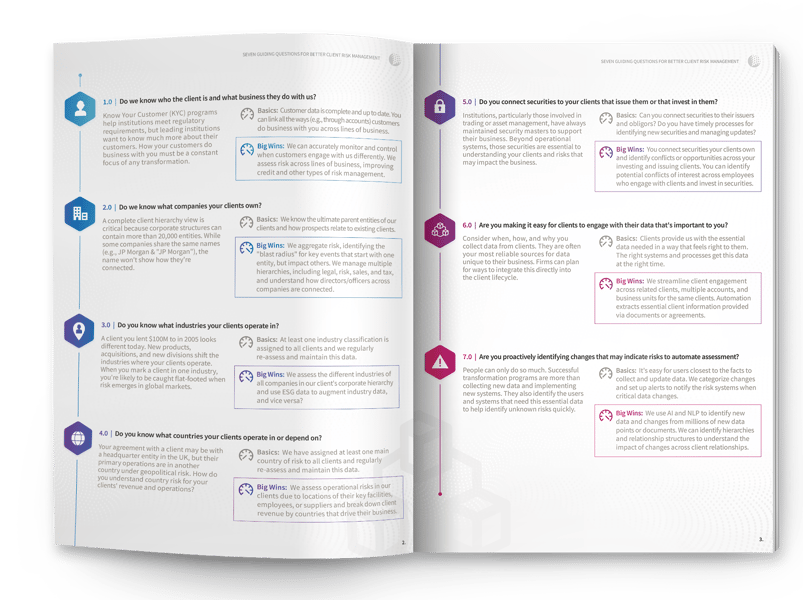

Institutions are addressing the moving target of risk management by prioritizing client-centric data as they transform their systems, processes, and operating models. Better understand the asset value of your customer information and benefit for decades.

Platform-based solutions solve complex data problems from independence compliance to enterprise data management. For nearly 30 years, banks, regulators, insurers, and retailers have relied on Kingland-designed solutions to make the most of their data.

Our software does not replace existing systems, it strengthens them. Kingland is your innovation partner, bringing together the full power of a secure cloud platform with proven data capabilities, customized for specific business needs. For over 30 years, banks, regulators, insurers, and retailers have relied on Kingland-designed solutions to make the most of their data.

Make the technology smarter.

Make the information work harder.

Make the operations stronger.

Kingland’s expertise in customer and account data dates back over 25 years, as does the Kingland track record of delivering software solutions to unique and challenging data requirements in the banking and capital markets industry. When FINRA needed a software partner to build the world's largest customer and account reference database, Kingland was the logical choice to make it possible.

One of the world‘s largest grocers wanted to optimize how its merchandise executives worked with vendors to provide the right product, at the right price, and at the right time. Using a system that would automate the contract process - updating prices, items, quantity, locations, and more - would allow this grocer to move the contract process along in a matter of minutes or hours rather than days.

The Global Bank‘s previous system required thousands of hours of manual input and still produced low accuracy. The low accuracy undermined confidence, increased costs, and introduced risk. See how Kingland modernized a global bank's 2 Million Record Credit Risk Problem.

Read the latest from our analysts and engineers.

Discover new ways to get the most from your data and learn how other industry leaders use data to transform business.